Why One should invest in mutual funds?

Reason 1: They are investments instruments which are capable of giving high returns . An average mutual fund scheme returns easily beats inflation in longer run and a good scheme can give far superior returns.

Reason 2: Our Mutual Fund industry is one of the best regulated industry in the world. They are governed by the strict guidelines layed down by SEBI(Securities & Exchange Board of India).

Reason 3: Investments decision of a Mutual Fund is taken by their AMCs and Fund Managers. They are experts who make investments decisions after doing intensive research and analysis of a company & industry. (Individuals generally don't have time and resources to do research hence best option is to let MF manage your investments)

Reason 4: This industry is highly liquid. Even more liquid than stock markets. Payments are generally made through cheques or in some cases they are directly credited to your bank accounts , If your bank is allowing RTGS & electronic clearing and mutual fund AMC is providing such facility.

Reason 5: Investments are diversified into many companies & sectors. Which make our investments safer and consistent growth prospects. Diversifying is usually not done by small investors , for such a actions one requires lots of funds.

Reason 6 : Tax treatments- Governments encourage investments in capital markets and has given many tax sops. Under i) 80(c) investments done upto one lakh in specific mutual funds schemes which is called ELSS(Equity Linked Saving Schemes.) are exempt from tax. ii) Any units held for more than one year if redeemed is treated under long term capital gain tax which is zero percent currently i.e. the whole profit is tax free. If one plans to redeem before one year then he has to pay tax of only15% on the profits.

Reason 7: Mutual Funds are much cheaper compared to direct exposure to capital market since one does not need demat account ,annual charge to maintain account, charges imposed on demat holdings, stamp duty on transaction are not levied .

Now, let's assume that this group of individuals is a novice in investing and so the group turns over the pooled funds to an expert to make their money work for them. This is what a professional Asset Management Company does for mutual funds. The AMC invests the investors' money on their behalf into various assets towards a common investment objective.

Hence, technically speaking, a mutual fund is an investment vehicle which pools investors' money and invests the same for and on behalf of investors, into stocks, bonds, money market instruments and other assets. The money is received by the AMC with a promise that it will be invested in a particular manner by a professional manager (commonly known as fund managers). The fund managers are expected to honour this promise. The SEBI and the Board of Trustees ensure that this actually happens.

Typical classification of mutual fund schemes on various basis:

Tenor

Tenor refers to the 'time'. Mutual funds can be classified on the basis of time as under:

1.Open Ended funds

These funds are available for subscription throughout the year. These funds do not have a fixed maturity. Investors have the flexibility to buy or sell any part of their investment at any time, at the prevailing price (Net Asset Value - NAV) at that time.

2.Close Ended funds

These funds begin with a fixed corpus and operate for a fixed duration. These funds are open for subscription only during a specified period. When the period terminates, investors can redeem their units at the prevailing NAV.

Asset Classes

1.Equity funds

These funds invest in shares. These funds may invest money in growth stocks, momentum stocks, value stocks or income stocks depending on the investment objective of the fund.

2.Debt funds or Income funds

These funds invest money in bonds and money market instruments. These funds may invest into long-term and/or short-term maturity bonds.

3.Hybrid funds

These funds invest in a mix of both equity and debt. In order to retain their equity status for tax purposes, they generally invest at least 65% of their assets in equities and roughly 35% in debt instruments, failing which they will be classified as debt oriented schemes and be taxed accordingly. (Please see our Tax Section on Page 39 for more information.) Monthly Income Plans (MIPs) fall within the category of hybrid funds. MIPs invest up to 25% into equities and the balance into debt.

4.Real asset funds

These funds invest in physical assets such as gold, platinum, silver, oil, commodities and real estate. Gold Exchange Traded Funds (ETFs) and Real Estate Investment Trusts (REITs) fall within the category of real asset funds.

Investment Philosophy

1.Diversified Equity Funds

These funds diversify the equity component of their Asset Under Management (AUM), across various sectors. Such funds avoid taking sectoral bets i.e. investing more of their assets towards a particular sector such as oil & gas, construction, metals etc. Thus, they use the diversification strategy to reduce their overall portfolio risk.

2.Sector Funds

These funds are expected to invest predominantly in a specific sector. For instance, a banking fund will invest only in banking stocks. Generally, such funds invest 65% of their total assets in a respective sector.

3.Index Funds

These funds seek to have a position which replicates the index, say BSE Sensex or NSE Nifty. They maintain an investment portfolio that replicates the composition of the chosen index, thus following a passive style of investing.

4.Exchange Traded Funds (ETFs)

These funds are open-ended funds which are traded on the exchange (BSE / NSE). These funds are benchmarked against the stock exchange index. For example, funds traded on the NSE are benchmarked against the Nifty. The Benchmark Nifty BeES is an example of an ETF which links to the stocks in the Nifty. Unlike an index fund where the units are traded at the day's NAV, in ETFs (since they are traded on the exchange) the price keeps on changing during the trading hours of the exchange. If you as an investor want to buy or sell ETF units, you can do so by placing orders with your broker, who will in-turn offer a two-way real time quote at all times. The AMC does not offer sale and re-purchase for the units. Today, ETFs are available for pre-specified indices. We also have Gold ETFs. Silver ETFs are not yet available.

5.Fund of Funds (FOF)

These funds invest their money in other funds of the same mutual fund house or other mutual fund houses. They are not allowed to invest in any other FOF and they are not entitled to invest their assets other than in mutual fund schemes/funds, except to such an extent where the fund requires liquidity to meet its redemption requirements, as disclosed in the offer document of the FOF scheme.

6.Fixed Maturity Plan (FMP)

These funds are basically income/debt schemes like Bonds, Debentures and Money market instruments. They give a fixed return over a period of time. FMPs are similar to close ended schemes which are open only for a fixed period of time during the initial offer. However, unlike closed ended schemes where your money is locked for a particular period, FMPs give you an option to exit. Remember though, that this is subject to an exit load as per the funds regulations. FMPs, if listed on the exchange, provide you with an opportunity to liquidate by selling your units at the prevailing price on the exchange. FMPs are launched in the form of series, having different maturity profiles. The maturity period varies from 3 months to one year.

Geographic Regions

1.Country or Region Funds

These funds invest in securities (equity and/or debt) of a specific country or region with an underlying belief that the chosen country or region is expected to deliver superior performance, which in turn will be favourable for the securities of that country. The returns on country fund are affected not only by the performance of the market where they are invested, but also by changes in the currency exchange rates.

2.Offshore Funds

These funds mobilise money from investors for the purpose of investment within as well as outside their home country. so we have seen that funds can be categorised based on tenor, investment philosophy, asset class, or geographic region. Now, let's get down to simplifying some jargon with the help of a few definitions, before getting into understanding the nitty-gritty of investing in mutual funds.

DEFINITIONS

Net Asset Value (NAV)

NAV is the sum total of all the assets of the mutual fund (at market price) less the liabilities (fund manager fees, audit fees, registration fees among others); divide this by the number of units and you get the NAV per unit of the mutual fund.

Standard Deviation (SD)

SD is the measure of risk taken by, or volatility borne by, the mutual fund. Mathematically speaking, SD tells us how much the values have deviated from the mean (average) of the values. SD measures by how much the investor could diverge from the average return either upwards or downwards. It highlights the element of risk associated with the fund.

Sharpe Ratio (SR)

SR is a measure developed to calculate risk-adjusted returns. It measures how much return you can expect over and above a certain risk-free rate (for example, the bank deposit rate), for every unit of risk (i.e. Standard Deviation) of the scheme. Statistically, the Sharpe Ratio is the difference between the annualised return (Ri) and the risk-free return (Rf) divided by the Standard Deviation (SD) during the specified period. Sharpe Ratio = (Ri-Rf)/SD. Higher the magnitude of the Sharpe Ratio, higher is the performance rating of the scheme.

Compounded Annual Growth Rate (CAGR)

What Does Compound Annual Growth Rate - CAGR Mean?The year-over-year growth rate of an investment over a specified period of time.

The compound annual growth rate is calculated by taking the nth root of the total percentage growth rate, where n is the number of years in the period being considered.

This can be written as follows:

Absolute Returns

Absolute Returns

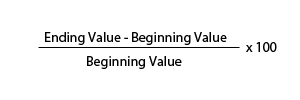

These are the simple returns, i.e. the returns that an asset achieves, from the day of its purchase to the day of its sale, regardless of how much time has elapsed in between. This measure looks at the appreciation or depreciation that an asset - usually a stock or a mutual fund - achieves over the given period of time. Mathematically it is calculated as under:

Generally returns for a period less than 1 year are expressed in an absolute form.